To download a report from Profitero+ on brand performance during Amazon Prime Day, visit the Profitero+ insights blog.

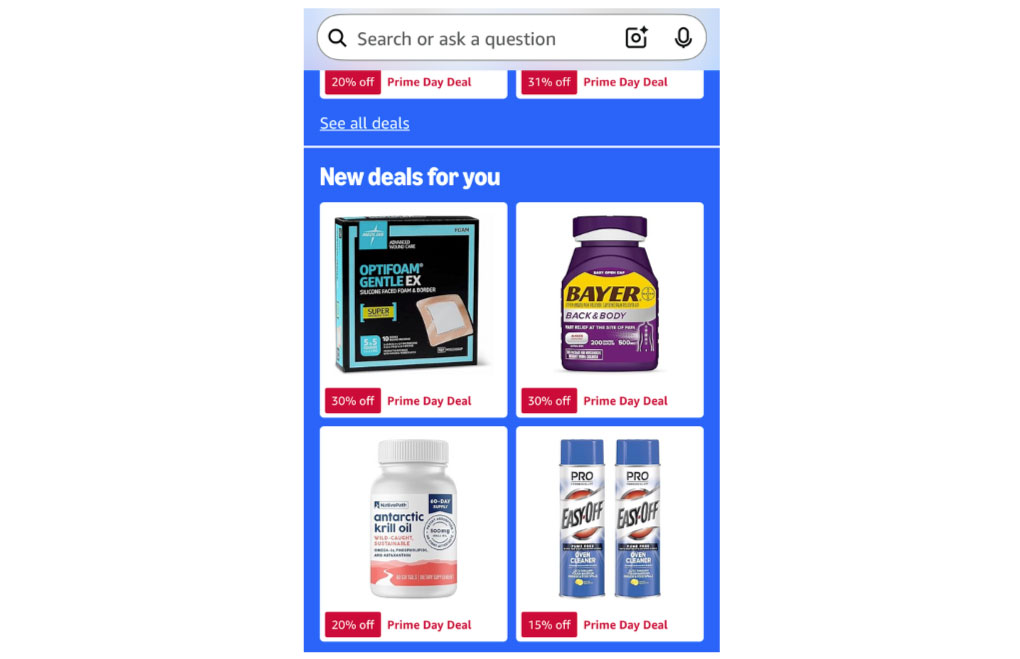

Does anyone need Antarctic Krill Oil? Amazon apparently thinks you do.

The alternative health remedy was one of the more unique products showcased prominently last week during Amazon Prime Day, the ecommerce giant’s ever-growing annual summer sales extravaganza — which this year strained its name more than ever before by becoming a 96-hour event running from July 8-11.

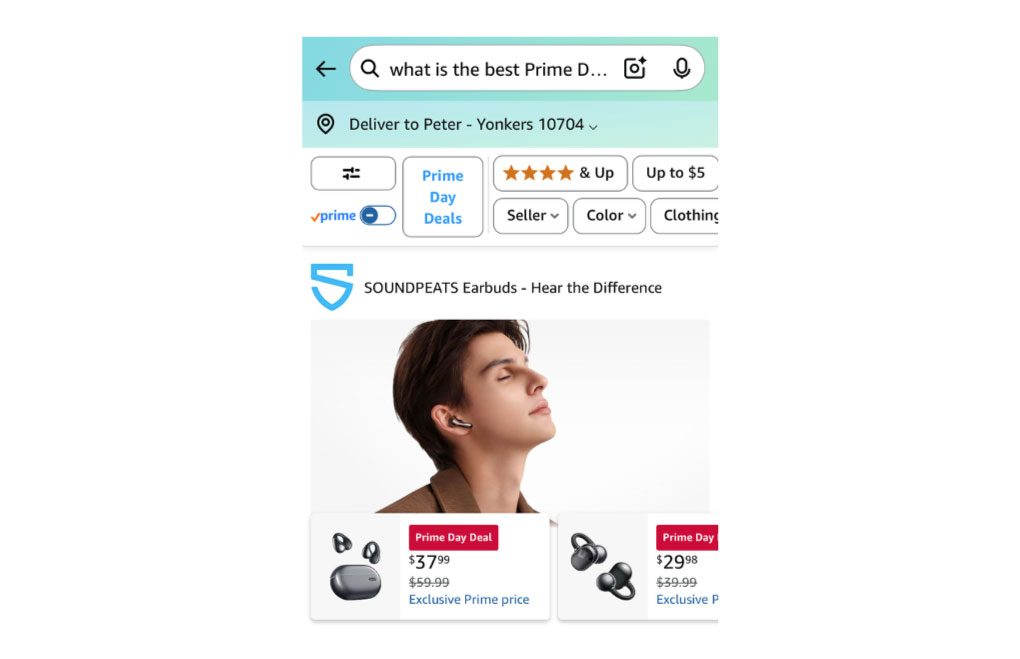

Then again, Alaskan Krill Oil’s prominence may simply have been an “inspired by your recent history” phenomenon for the author of this article, as Amazon’s algorithm worked to present relevant products that each of its 180 million Prime members were likely to purchase. (Rufus, by the way, was spot on when he suggested “earbuds” as lead option to the query, “What is the best Prime Day deal for me?”)

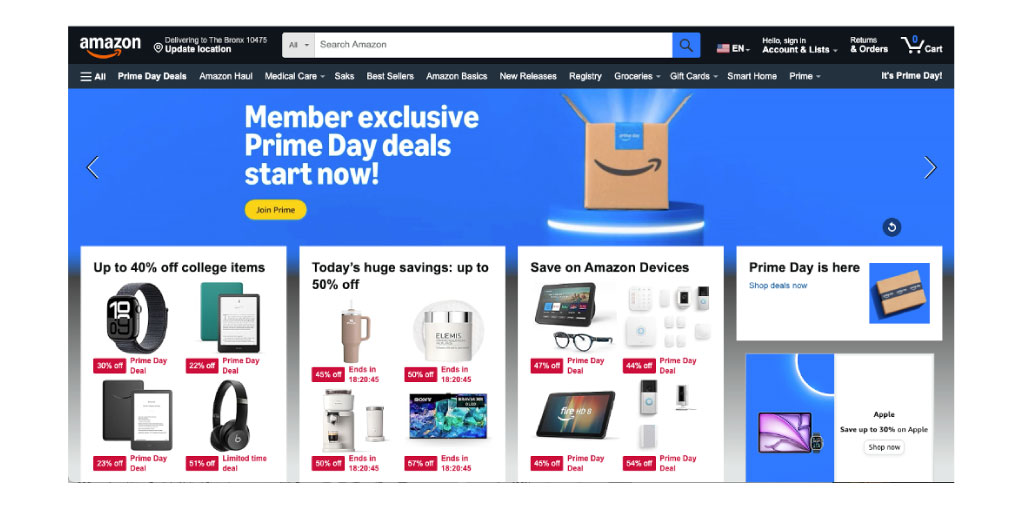

Not that Amazon didn’t also universally pitch a variety of products to the masses as well. Promotions at the top of the e-tailer’s home page were dominated by deals “up to 50% off” for electronics (especially its own devices), back-to-school (and college) necessities and apparel, among other typically popular Prime Day categories.

The event was a success by everyone’s estimations. Amazon called it “bigger than any previous four-day period that included a Prime Day event, with record sales and more items sold.” The company never discloses actual sales figures, of course.

Adobe Analytics, however, estimates that Prime Day helped drive $24.1 billion in total U.S. ecommerce spending over the four days, a 30.3% increase from the same period in 2025 that is also twice the amount spent last year on Black Friday ($10.8 billion).

That total was aided by the many other retailers that now host competing events, including Walmart, Target, and Best Buy. Even Dollar General got in on the action this year with “7 Days of Savings.”

Leading Categories and Brands

Numerator estimates that Amazon Prime Day shoppers spent an average of $156.37, with most households (63%) placing more than one order. The most popular items (based on units purchased) were Premier Protein Shakes, Dawn Platinum Powerwash, Liquid I.V. packets, the Amazon Fire TV stick, and Amazon Basics paper plates. Leading categories were apparel, household essentials, home goods, health and wellness, and beauty — all of which were purchased by 25% or more of the 5,000 shoppers in Numerator’s survey.

Incidentally, this is the second straight year in which Liquid I.V. was identified as a top seller. Amazon itself plugged the hydrating drink mix as among the best sellers in 2024 — which may be why the brand secured prominent home-page ad placement this year.

Amazon’s own post-event announcement also listed electronics as a top category (it was 6thin the Numerator survey) and name-dropped Dyson, skincare-focused Medicube, and Philips Sonicare as leading brands. Among the specific products mentioned were Apple AirPods Pro 2, Biodance Bio Collagen Real Deep Mask, and Dawn Platinum Powerwash.

In addition, “Prime members stocked up on grocery deals like 50% off all ice cream and frozen desserts at Whole Foods Market and $30 off purchases of $150 or more across all Amazon Fresh selections, including fresh produce and other perishable items,” according to Amazon. More than one-third of respondents told Numerator that they shopped for the same items they typically purchase on Amazon, which has made Prime Day an important event for packaged goods brands as well.

Across the ecommerce ecosystem, Adobe reported that Prime Day “has also been cemented as a ‘back-to-school’ shopping moment, as consumers took advantage of deals and got a head start on purchases.” Sales of basic supplies like backpacks, binders, and kids' apparel rose 175%, while dorm-room needs such as microwaves, bed linen, and cleaning products increased 84%, Adobe said.

The Impact of AI

Amazon also boasted that “this year’s Prime Day experience was enhanced by Alexa+ — Amazon's next-generation personal assistant — along with the AI-powered shopping assistant, Rufus, and AI Shopping Guides. These features helped customers easily discover deals and get product information.”

Adobe concurred, noting that, across the ecommerce landscape, “shoppers are increasingly using generative AI-powered chat services and browsers as a shopping assistant.” During the Prime Day period, generative AI-driven traffic to U.S. retail sites (as measured by clicks) skyrocketed 3,300% compared with 2024. And while total usage “remains modest compared to other channels (paid search, email), the growth shows the impact of AI on shoppers,” Adobe said.

Paid search did, in fact, remain the leading driver of ecommerce sales during the period with a 28.5% share of revenue (up 5.6% from 2024), “Affiliates and partners,” which includes social media influencers, increased their impact by 15% to gain a 19.9% share. Adobe also found that influencer content converted shoppers 10 times more than social media overall.

Prime Day Insights from Profitero+

Profitero+, Publicis Commerce’s resident ecommerce analytics agency, conducted a Prime Day analysis of six key product departments: Beauty & Personal Care, Electronics, Grocery & Gourmet Food, Home & Kitchen, Tools & Home Improvement and Toys & Games. The resulting report provides an in-depth understanding of performance during the Prime Day event, examining top brands by share of sales as well as promotional and price-discount activity.

The report once again proves that Amazon.com offers a level playing field for brands of all sizes to gain (or buy) a strong presence during critical seasonal sales windows like Prime Day. And since the top-selling brands don’t often also rank among the top promoted ones, it again illustrates the need for a comprehensive digital shelf strategy that goes well beyond the media spend.

To download the report, visit the Profitero+ insights blog.